Are you ready to apply for your VAT refund?

May 18, 2020

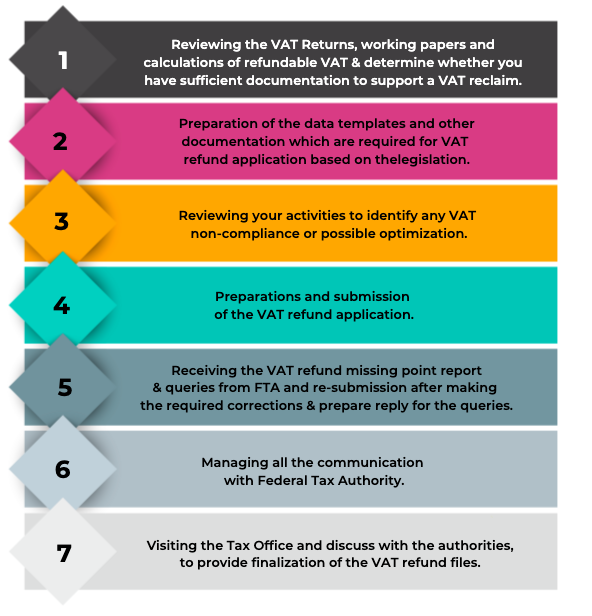

Recovering Value-Added Tax (VAT) is a crucial part of an effective indirect tax strategy. It is important for taxpayers to know not only in which cases they have the right to demand tax refund, but also how to get prepared in order to obtain the requested tax refunds in a short period of time.It is crucial that the tax refund file to be submitted to the tax office is prepared completely, and all other procedures of VAT refund has been compiled correctly in order for the claimed amount to be received in the shortest period of time and without any problems.

Barriers to recovering VAT include a lack of understanding of the detailed indirect tax rules, difficult administrative procedures, and insufficient or incorrect documentation as well as missed deadlines for reply to Federal Tax Authority.

Unclaimed tax credits and missed or delayed refunds commonly cause negative cash flow and “tax leakage” that increase business costs and reduce profitability. Businesses in UAE may expect earlier refunds of value-added tax (VAT) as a relief measure in response to the coronavirus (COVID-19) pandemic. Tax professionals believe that the federal tax authority may have already accelerated the processing of VAT refunds with regard to returns that have been submitted.

We Can Help You In:

How MBG can help for VAT Refund:

- We are a registered tax agency with Federal Tax Authority.

- We are comprised of professionals dedicated to client satisfaction and high quality.

- We are willing to share our deep knowledge and experience in tax refund procedures, where these procedures mostly involve highly complicated, exhausting and detailed bureaucratic processes.

- We use our extensive network of Tax Agents & VAT professionals.

- We can assist your business to develop or improve related business processes to reduce the time and administrative costs associated with making claims and increase your chances of success.

Vipin Kumar Ahuja

Designation: Associate Director

About Author:Associate Director – Taxation (VAT, Excise & Customs)

Chartered Accountant, DISA, Dip. in IFRS.

Having over 12 years of experience in advising clients on Direct & Indirect tax and regulatory issues across India, UAE, KSA and Bahrain.

Areas of Specialization:

– Value Added Tax (VAT)

– Excise Tax

– Custom

– Transfer Pricing

– Project Management

– Process Improvement

– Risk Management