CBDT Introduces Changes for Assesses Opting for Concessional Tax Rates Under New Tax Regime

November 23, 2020

The Central Board of Direct Taxes (“CBDT”) vide Notification No. 82/2020 dated 01.10.2020, has introduced certain changes in Income Tax Rules, Income Tax Return (“ITR”) Form, Tax Audit Report (“Form 3CD”) and Transfer Pricing Report (“Form 3CEB') in relation to assessees opting for concessional tax rate under new tax regime as per the provisions of Section 115BAA, 115BAB, 115BAC and 115BAD read with Section 295 of the Income Tax Act, 1961 (“the Act”).

1. Changes in Income Tax Rules, 1962a) Maximum depreciation on any block of assets has been restricted to 40%.

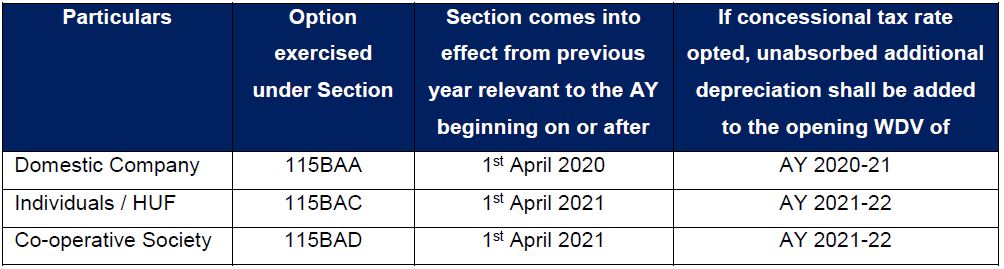

b) Unabsorbed Additional Depreciation under the provisions of Section 32(1)(iia) shall not be allowed and shall be added to opening WDV of the block of assets as under:

2. Changes in Form 3CD

2. Changes in Form 3CD

Form 3CD has been amended to include reporting under provisions of new tax regime with respect to adjustments related to unabsorbed additional depreciation and brought forward losses as under:

a) New Clause ‘8a’ has been inserted to report whether an assessee has opted for new tax regime.

b) New Sub-clauses ‘(ca)’ and ‘(cb)’ has been added to Clause 18 w.r.t. ‘Fixed Assets’ to report -- “Adjustment related to unabsorbed additional depreciation made to the opening WDV u/s 115BAA (for AY 2020-21 only)” and “Adjusted WDV” respectively.

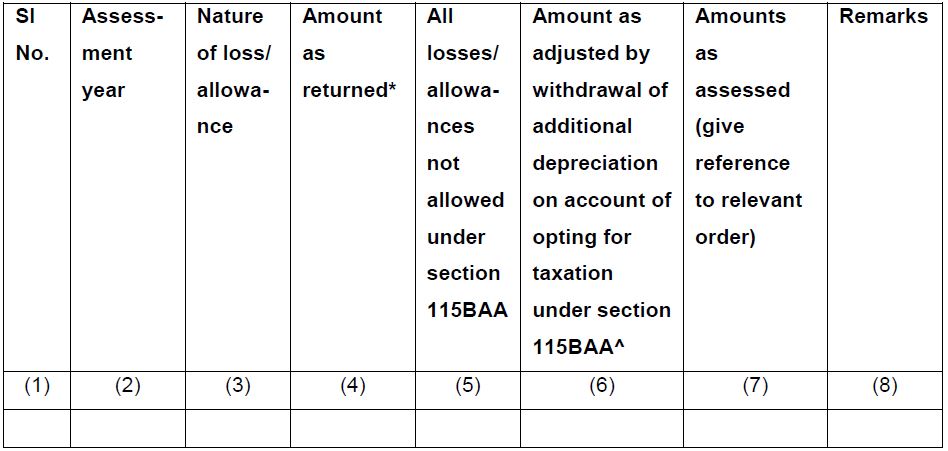

c) Clause 32(a) has been substituted by new Clause, which requires — details of ‘brought forward losses’ and ‘unabsorbed additional depreciation’ for the companies opting for concessional tax rate under new tax regime u/s 115BAA of the Act. in the following manner, to the extent available.

*If the assessed depreciation is less and no appeal pending, then take assessed.

^To be filled in for assessment year 2020-21 only.

3. Changes in ITR Form (ITR-6)Similar reporting requirements have also been introduced in ITR Form to report adjustment related to unabsorbed additional depreciation and brought forward losses which are not allowed under new tax regime.

4. Changes in Form 3CEBPart C of Form 3CEB has been amended to report — details of specified domestic transactions with any new manufacturing domestic companies opting for concessional tax rate as per Section 115BAB of the Act. Details have to be reported whether the transaction has been carried out at arm’s length price or not.

5. Introduction of New Forms for exercising options u/s 115BAC and 115BADNew Forms viz. Form 10-IE has been notified for assessees (Individual / HUF) exercising or withdrawing, as the case may be, option u/s 115BAC(5)(i) of the Act, and Form 10-IF has been notified for assessees (Co-operative Society) exercising option u/s 115BAD(5) of the Act.

Note: For detailed formats & forms, covering the above changes, Notification No. 82/2020 dated 1st October, 2020 may be referred.

Last updated: 19/11/2020

Article contributed by:

Manager - Direct Tax

MBG Corporate Services