Decoding Union Budget 2020

On February 01, 2020, Hon’ble Finance Minister Smt. Nirmala Sitharaman presented her second budget for Financial Year (“FY”) 2020-21 (“Budget”) of Narendra Modi 2.0 Government.

The Indian economy has witnessed a slowdown in growth in the Fiscal Year 2019-20 as GDP grew at 5% and is expected to stabilize at 6-6.5%% for the year 2020-21. The fiscal deficit is estimated at 3.5% of GDP for 2020-21. The inflation rate is at 7.4%.

In September 2019, the government had slashed tax rates to 15 percent for new manufacturers and 22 percent for existing companies from about 30 percent to energize the Indian corporate sector. Continuing with the same momentum, the government has considered a cut in personal income-tax rates especially for the lower-income groups leading to an annual potential tax saving of INR 78,000/-. This is expected to spur consumption and demand. The Government has also announced a scheme to unlocking tax dues stuck in litigation.

The Budget mainly focuses on the Government’s vision to drive India to higher economic growth and become a five trillion-dollar economy in the next few years. The Budget lists down the Government’s macro-economic plans for boosting sustained economic growth. The focus of the government has been on increasing the ease of living through three themes — Aspirational India, Economic Development and Caring Society.

We are pleased to provide you with the synopsis of the Union Budget of 2020 and hope the same shall be useful at your end.

Our Budget Experts

Business Law Advisory Tax Consultancy & Exchange Control Regulations.

International Tax Advisory, Cross-border Transactions, Entry & Exit Strategy Formulation.

Strategy and Implementation, Business Re-structuring, Statutory Compliances & Business Valuation.

Corporate Law, Capital Market, Financial Services, Due Diligence, Merger/Amalgamation/ Take-over & Private Placements.

Strategy & Implementation, Audit, and International Financial Reporting Standards, Internal Control & Risk Management.

Indirect Taxes-Customs/GST, Foreign Trade Policy, Indirect Tax Advisory, Indirect Tax Compliance Health Check & Due Diligence.

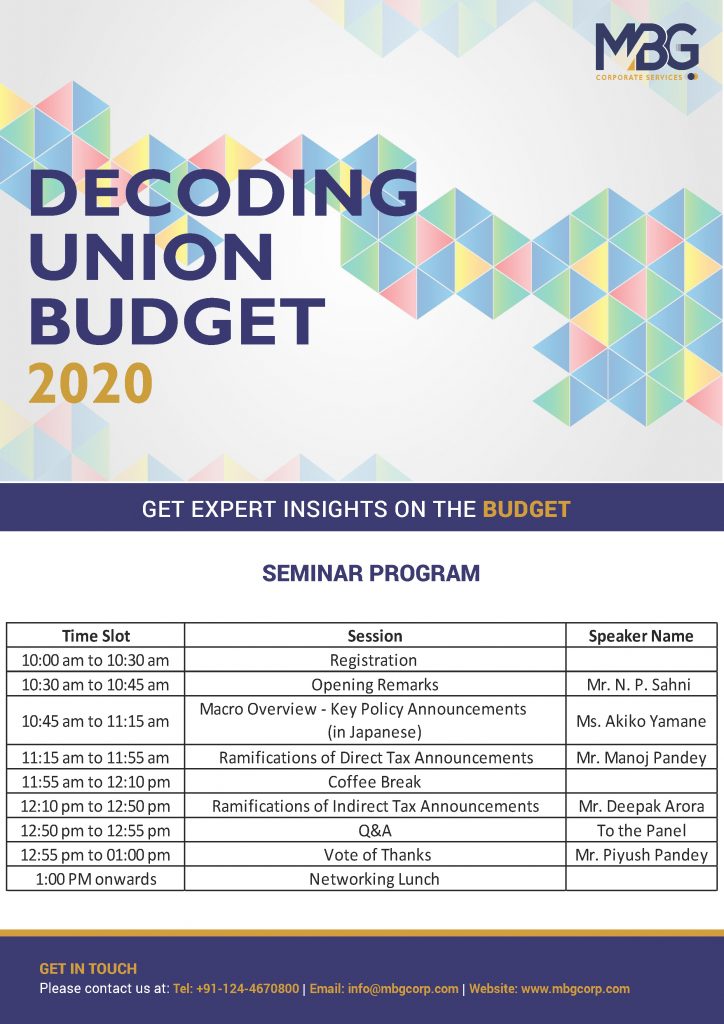

DECODING UNION BUDGET 2020 – MBG SEMINAR

MBG Corporate Services is organizing “Decoding Union Budget 2020” a seminar to analyze and understand the impact of the Union Budget 2020. Our leaders will analyze the budget in detail.

contact us at [email protected]