Labour Accommodation Exempt from VAT

The Federal Tax Authority has classified labour accommodation into two categories for tax payment purposes:

- facility providing additional services making it subject to the standard 5 % Value Added Tax (VAT)

- residential building and therefore exempt from VAT

Condition

- Principal place of residence for employees.

- A building fixed to the ground and which cannot be moved without being damaged.

- The building was constructed with a lawful authority.

- The building is not similar to a hotel, motel, bed & breakfast establishment or services apartment for which services in addition to the supply of accommodation are provided.

Additional Services that may be Offered

- Cleaning of commercial areas

- Maintenance services of the property

- Pest control

- Security

- Utilities, e.g. electricity, water, etc.

- Access to facilities within the building for residents to use themselves e.g. launderette

- Facilities within the building (gym, pool, prayer rooms)

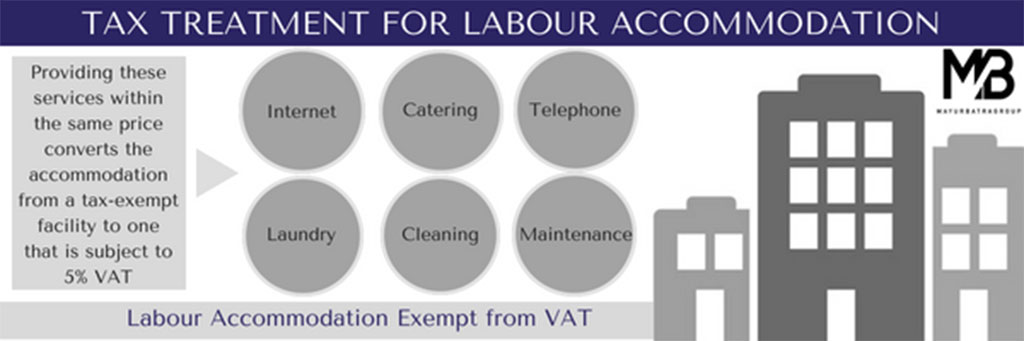

Providing below Services within the same Price converts the Accommodation from a Tax-exempt facility to one that is subject to 5% VAT

- Telephone and internet access

- Cleaning of the rooms

- Laundry services

- Catering

- Maintenance services (other than those required for the general upkeep of the property)

Tag: Accomodation, Labour, Uae, Vat