Qatar VAT Exemptions and Zero-Rated Supplies: What Businesses Need to Know?

Are you unsure which sales in Qatar escape tax or face a zero rate?

That confusion can cost time, fines, and missed cash flow. Here’s the problem: many teams treat VAT rules as optional guidance. They do not. Mistakes slow projects and hurt margins.

This post shows what matters, what to watch, and what to act on. Read carefully and use the check points.

Key points on How Qatar VAT Actually Works

Qatar VAT applies at the point of supply. It affects pricing and contracts. Firms must register when they meet the threshold. For many, VAT changes cash flow and record-keeping. For others, VAT alters which products win tenders.

As a result, a clear grasp of VAT Exemption and Zero-Rated Supplies matters to procurement, sales, and finance teams. If you miss a rule, you face assessments and extra tax. So, prepare your processes. Then train the team. Next, keep the paperwork ready.

Mapping VAT Exemption Categories

Many supplies are exempt. Exempt means no tax, and no right to claim input tax on costs. That point trips up many businesses.

Below is a table to show common categories and everyday examples.

| Category | Typical examples |

| Financial services | Core banking fees, certain loan services in return for implicit margin like interest or profit. |

| Domestic Passenger Transportation | Local passenger transport within the State, whether by land, water, or air, using vehicles or vessels designed for passenger use (e.g., taxis, buses, trains, ferries), |

| Land and Buildings |

Buildings: Residential properties for lease (more than 6 month and occupant must be a holder of an Emirate I.D) Land : Supply of Bare land |

Remember, the exact scope can vary. You must map each service or product to the rule. An item that looks exempt at first can fail on closer review. That risk makes review essential. If you see frequent queries from auditors or if your input tax claims are large, get help.

Understanding Zero-Rated Supplies

Zero-rated supplies mean you charge no VAT. Yet you can reclaim VAT on costs that relate to those supplies. That trait makes them powerful. By contrast, VAT Exemption stops both the tax on sale and the right to reclaim.

For a Qatar Business, that difference affects pricing, bidding, and profitability. The following table sets out selected examples of supplies that qualify for zero-rating under UAE VAT legislation.

| Category | Typical examples |

| Export of Goods and Services | This includes, but is not limited to, consultancy services, IT and software solutions, architectural and engineering services, as well as the export of raw materials such as aluminum and retail products like luxury perfumes or clothing to non-residents. |

| Educational services | Educational Services provided by approved qualifying educational institutions (e.g., nurseries, schools etc.) |

| Healthcare | Qualified medical services and hospital care, including vaccinations, human medical treatment, dental services, medicines, and medical equipment, etc. |

| International Transport of Goods and Passengers. | Supply of a means of transport (air, sea and land) for the commercial transportation of goods and passengers (over 10 people) outside the UAE. This includes international Air ticket by passengers, Air freight of electronics, Truck transport of goods, courier services, cruise ship journey etc. all being transited outside the UAE |

| Investment grade precious metals | Example includes: Gold, sliver of 99% purity |

Common VAT Zero-Rated Items That Matter to Exporters and Service Firms

Think of Zero-Rated VAT supplies as those that keep input tax recoverable. Typical groups include exports and international transport-related services. Also, some goods supplied to special zones or certain supplies to diplomatic bodies may fall here.

For a Qatar Business, this list affects how you price and how you recover VAT on purchases. If your company exports services, you must document the export element. In addition, you must keep proof of movement when goods cross borders. That evidence makes the difference between zero rate treatment and a full VAT charge.

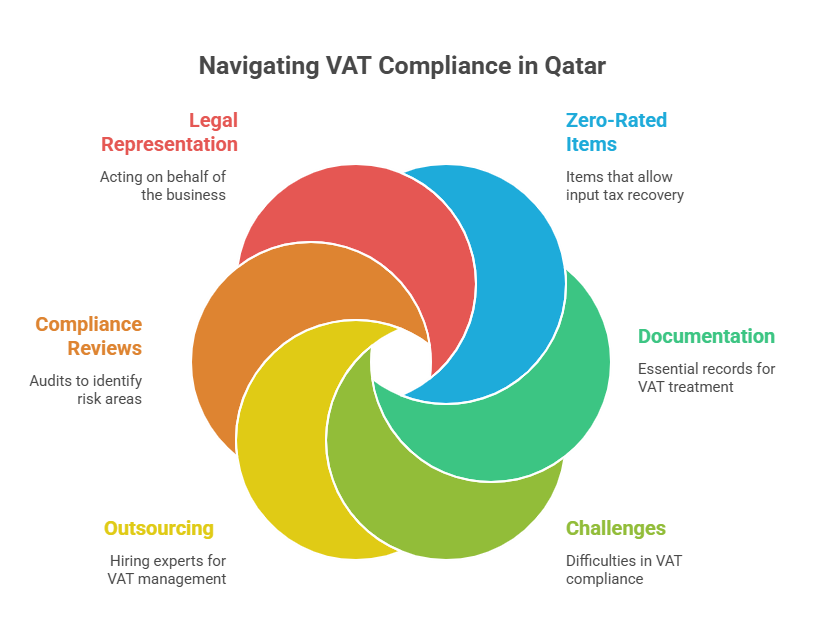

Operating VAT in a strict regime brings real challenges for any firm. Staff need training on the rules and on the filing process. One slip can cause penalties. For that reason, many businesses outsource VAT compliance to registered tax agents. These agents work with the revenue office and help you meet disclosure obligations.

They also run VAT Compliance Reviews and VAT Health Checks to find risk areas. They can act as your legal representative when needed. When you choose a trusted adviser, you reduce burden and keep your focus on core work.

How to Document Zero-Rated Supplies and VAT Exemption Claims ?

Good documentation wins disputes. For Zero Rated Supplies you need proof of export, contracts, and transport documentation. For VAT Exemption you must keep licenses, permits, and detailed invoices. Also, date stamped paperwork helps.

Keep separate ledgers for zero-rated lines. Reconcile input tax on a regular basis. Keep evidence that supports the place of supply. That evidence includes shipping records and written confirmations from overseas buyers. If you do this well, you lower audit risk. If you skip it, you will spend days fixing errors.

Why Using VAT Consultants Keeps Your Filing Error-Free?

Operating VAT in a strict regime brings real challenges for any firm. Staff need training on the rules and on the filing process. One slip can cause penalties. For that reason, many businesses outsource VAT compliance to registered tax agents.

MBG Corporate Services works as a trusted partner for companies facing these exact issues. We run VAT Compliance Reviews, VAT Health Checks, and VAT Smart Reviews to identify weak points and fix them.

The Final Words

Review all export contracts. Check every invoice for correct tax wording. Separate exempt lines. Tag zero-rated lines in your ledger. Keep shipment evidence. Train the team. Book a VAT health review if you have doubts.

If VAT rules still feel like a guessing game, fix that now. Start with a VAT reclassification review. Then secure a VAT health check from MBG Corporate Services, a registered consultant in the region.

If you want help mapping VAT Exemption or identifying Zero Rated Supplies for your Qatar Business, get in touch. We can run a focused review, prepare your documentation, and coach your team.

Act now and protect margins!