Automation of credit card Reconciliation Process

March 11, 2022

Unattended Automation

Client and engagement information

The Client is a leading multinational supermarket chain active in UAE, Qatar, Lebanon, Oman and Pakistan. The client has about 77+ locations and the headquarters is in Dubai, UAE.

The Challenge

The business process was routine, time consuming and mundane with multiple repetitive steps. Client was processing very crucial data on daily basis and sent to the head office, the absence of which, would impact key decision-making processes.

Data standardization was one of the major roadblocks in reconciliation process.

Process being so tedious was prone to errors and errors at any stage of the process would require the entire report to be reworked.

The client was looking for a solution to increase efficiency, reduce operation costs and risks, whilst optimizing resources’ time to focus on value adding activities for the business.

Key Information

| Industry: | Retail (Convenience stores) |

|---|---|

| Geographies implemented: | UAE |

| Automation tool used: | Automation Anywhere |

| Department: | Finance Operations |

| Sub-Department: | Credit card |

| Engagement model: | Automation as a Service – Research, consulting, execution at a fixed price per process and RPA training |

| Domain(s) covered: | Finance |

| Volumes: | 15,000 Transactions per day |

Resources required to complete the manual process:

Process (es) covered:

| Type of automation: | Unattended |

| Type of process: | Back office |

| Application used: | SAP, Websites, Email, spreadsheet |

Solution: Our Approach

RPA maturity assessment

Using our proprietary RPA maturity framework, MBG accessed the business process to ascertain the feasibility of Robotics Process Automation (RPA). Each process step was analyzed in detail, to optimize the business process cost-effectively. The assessment included designing a compelling business case. The business case was developed using various metrics obtained from the client such as Average handling time and SLAs among others. The RPA maturity rating, as per our framework, validated that this process was the ideal candidate for Robotic Process Automation.

RPA Implementation

The assessment concluded that the process was viable for automation and demonstrated an effective business case. MBG automated the business process as per its RPA Development Lifecycle. The MBG team performed user acceptance testing (UAT) and deployed the automated process into production. The client’s finance and Product and control team was trained in BOT usage and exception handling, as a part of supporting their routine operational activities.

Hypercare (Support period)

MBG also provided RPA technical training for the selected staff from the client to enable them to manage and support the robots deployed and shared a Handbook accordingly.

Manual Process (AS-IS)

- Download the Bank statements from bank portals for a specific period

- Download network International statements which are in PDF format from the mails.

- Download each store’s daily transactions report from SAP.

- Populate the commission file with Bank credits, SAP Debits, and total commission, total VAT, and total fee from network international statements for each store.

- Check for double charges, ENBO redemption points and previous day’s transactions in NI statements.

- Post daily transactions to SAP.

- Prepare reconciliation file with data from network international statements, Bank statements, and sales statement downloaded from SAP.

- Update the daily tracker file for management reporting.

- Sends report to management for review.

- Currently processing time- 8hrs

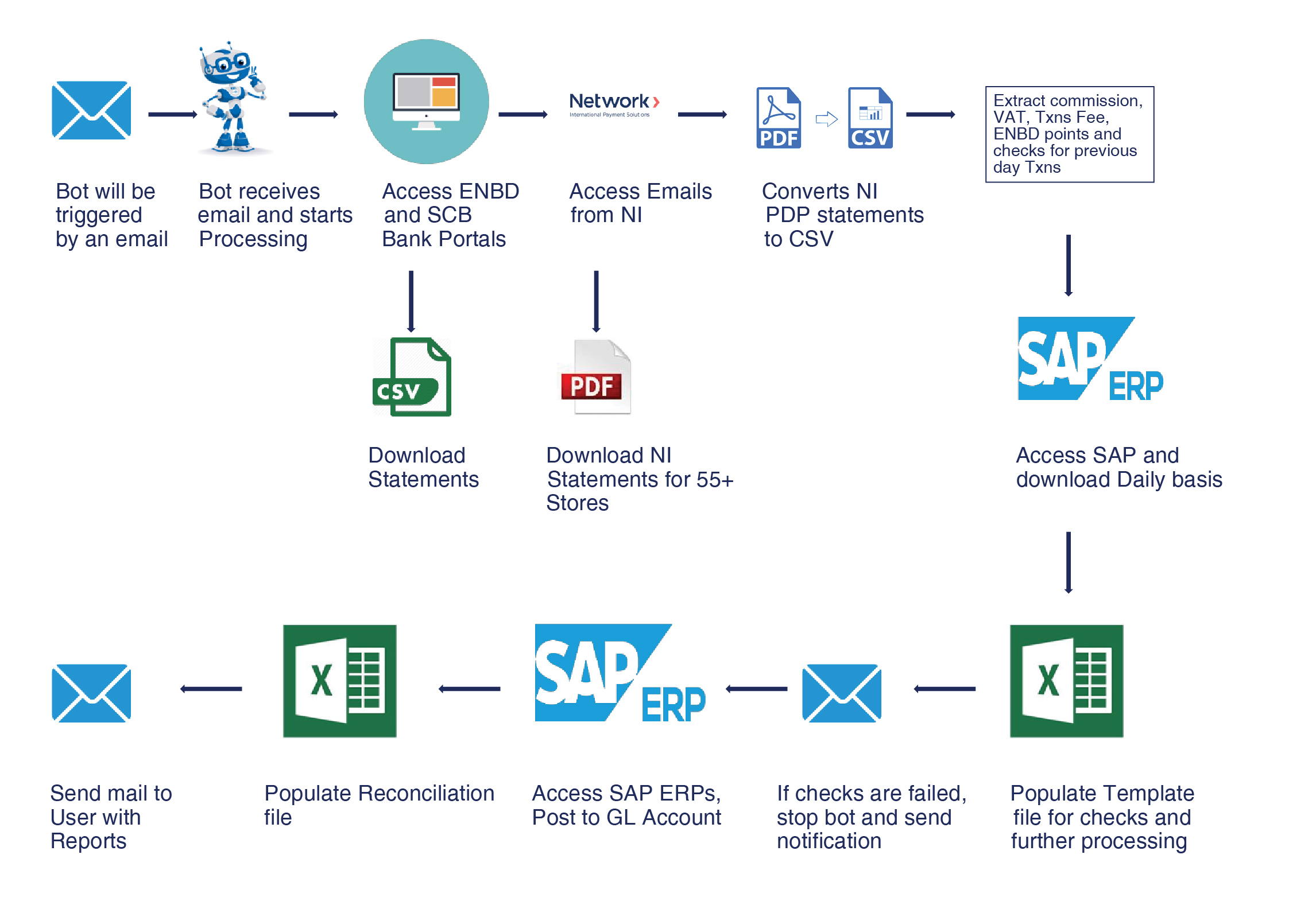

Automated TO-BE:

- Robots waits for trigger email

- Read email with subject ‘run card recon bot’

- Create standard folders

- Login to Bank portal

- Send email to user requesting OTP

- Login to Portal

- Download the bank statement

- Login to SAP system

- Download daily sales report

- Extract credit from bank statement

- Populate template file

- Download Network international statements from email

- Convert PDF files to text then to CSV

- Check for business rules

- Populates commission file

- Sends notifications to user

- Update daily sales to template file

- Login to SAP

- Post commission VAT. Gross amount

- Populate recon file with debits and credits

- Populate daily tracker file

- Send success email

Credit Card Reconciliation

Benefits/value Delivered

The automation of the process resulted in the following benefits:

- 100% effort automated and Quality improvement to 100% accuracy

- Improved SLAs on report submission as Processing time is reduced by 95%

- Higher standardization of process

- Re Deployment of 0.5 FTE to other Value added services

- Direct monetary benefit of $27,000

- Re-deployment of 1 FTE on-shore.

- Reduction in AHT from 8 hours to 15mins

- Reduction in errors