IFRS 17 | INSURANCE CONTRACTS

December 14, 2018

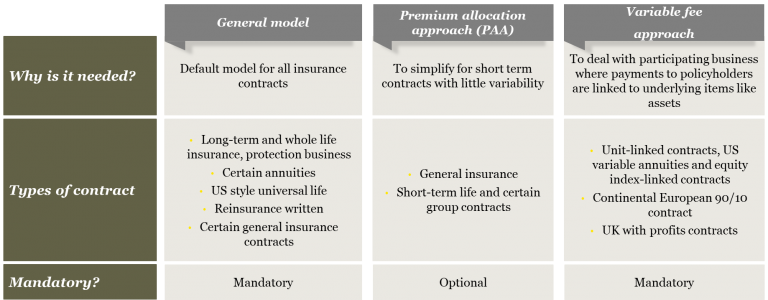

The new 'Insurance Accounting Standard - IFRS 17', issued after 20 years of development, introduces a principle-based accounting and deals with recognition, measurement, presentation and disclosures requirements for insurance contracts. It specifies approaches for measurement of insurance contracts, General Model, Premium Allocation Approach and Variable Fee Approach. It also deals with the presentation in the statement of financial performance in respect of Insurance Contracts.

OVERVIEW OF THE MEASUREMENT MODELS

CRITICAL AREAS TO LOOK FOR OR JUDGEMENTS REQUIRED?

- Level of aggregation

- Adjustment of non-financial risk in measuring liability for incurred claims

- Assessing fulfilment cash flows

- Adjustments to reflect the time value of money

HOW IFRS 17 CONTRIBUTES TO FINANCIAL STABILITY*

*Source: Speech by chair of the International Accounting Standards Board (Board) Hans Hoogervorst in Washington DC, United States on 11 December 2018

TRANSITION TO NEW STANDARD

An entity shall apply the Standard retrospectively unless impracticable, in which case entities have the option of using either the modified retrospective approach or the fair value approach. At the date of initial application of the Standard, those entities already applying IFRS 9 may retrospectively re-designate and reclassify financial assets held in respect of activities connected with contracts within the scope of the Standard.

EFFECTIVE DATE

The new standard supersedes IFRS 4 – Insurance Contracts and is applicable for periods beginning on or after 1 January 2022. The new standard can also be adopted early if both IFRS 15 – Revenue from contracts with customers and IFRS 9 – Financial Instruments have been applied.

HOW CAN WE HELP

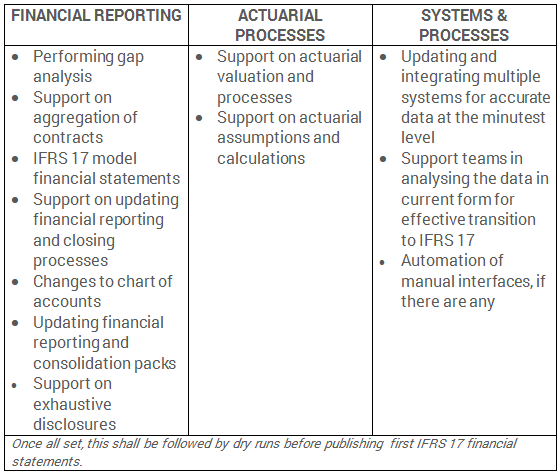

Implementing IFRS 17 will require not just changes from the accounting and financial reporting perspective but also demands holistic changes to systems and processes, data capturing, management reporting/information systems and actuarial models.

We can help insurers in transitioning to IFRS 17 as follows: