Accounting outsourcing can help businesses save cost, improve accuracy and compliance, manage risk, and focus on their core operations. Streamline financial processes and boost accuracy with accurate reporting.

Reasons why Accounting & Bookkeeping become a top priority for businesses

Key Importance

- It gives a clear analysis of financial data

- Financial & Tax reporting is accurate and transparent

- Making Strategy for your business is easier

- Your business is safe from violations and penalties

key reasons for Accounting & Bookkeeping Outsourcing

- Analyse the financial data and determine areas for improvement. This is crucial for the long-term health of the business

- Prepare financial statements based on the Generally Accepted Accounting Principles (GAAP)

- You will get customized advice based on your unique business needs.

- Using a third-party accountant ensures that you’ll receive unbiased information that is verifiable and objective

- The accountant acts as a financial advisor and helps you with budgeting and monitoring cash flow on a steady basis

- Helps you during tax season as accountants can identify potential deductions and help avoid audits

- Help to comply with Auditors.

Business Accounting abreast from Tax Record Penalties:-

Violation: Failure to keep the required records specified by the tax procedures law and the tax law.

- Penalty: AED 10,000 for the first time. AED 50,000 for each repeat violation.

Violation: Failure to submit the required records in Arabic when requested by the Authority.

Violation: Failure to inform the Authority of an amendment to tax records that need to be submitted.

- Penalty: AED 5,000 for the first time. AED 15,000 in case of repetition.

Deliverables

Monthly Report

- Analytical Sales & Purchase Report

- Analytical Expenses Report

- Trial Balance

- Bank Reconciliation

- Profit and Loss Account

- Balance Sheet

- Ratio Analysis

Quarterly Report

- Analytical Sales & Purchase Report

- Analytical Expenses Report

- Trial Balance

- Bank Reconciliation

- Profit and Loss Account

- Balance Sheet

- Quarterly VAT Return Working8. Quarterly VAT Return Submission

- Quarterly VAT Refund Submission

- Cash Flow Statement

- Ageing Analysis for Sundry Creditors

- Ageing Analysis Sundry Debtors

Annual Report

- Analytical Sales & Purchase Report

- Trial Balance

- Bank Reconciliation

- Profit and Loss Account

- Balance Sheet

- Cash Flow Statement

- Notes to Accounts for Financial Statements

- Ageing Analysis for Sundry Creditors

- Ageing Analysis Sundry Debtors

- Analytical Expenses Report

- Fixed Asset Register and Depreciation Report

- Ratio Analysis

Benefits of Accounting Outsource:

Access to skilled specialists

Outsourcing gives you access to our team of experienced professionals who will use their (local) knowledge and expertise to identify opportunities to strengthen controls, improve processes and increase efficiency

Cost savings

Outsourcing delivers cost savings, not only in areas such as salaries but also in technology and infrastructure. You can save when investing in the latest technology, software and infrastructure by letting us manage it for you

Increased efficiencies & streamlined processes

Outsourcing provides you with increased efficiency, productivity and economies of scale, giving you an important competitive advantage.

Focus on core activities

Outsourcing your financial and administrative functions will free you to concentrate on achieving your strategic business goals and realise your entrepreneurial dreams.

Risk management

Our Accounting & Tax Outsourcing team provides you with the confidence that you are fully compliant with statutory and compliance obligations.

Peace of mind

You can carry on running your business with the assured knowledge that all your financial and administrative processes are running efficiently and effectively

Scope of work – Accounting & Bookkeeping Services

- Journal entries preparation

- Posting of Revenue / Sales

- Posting of Payments

- Petty Cash Accounting.

- Posting of material receive

- Payroll accounting

- Fixed assets, depreciation

- Accounts Receivable

- Credit and debit adjustments.

- Posting of journal entries

- Posting of Receipts

- Posting of Purchase Invoices

- Posting of material issued

- Projects Accounting

- Administration expenses

- Banks reconciliation

Scope of work – VAT Compliance Review

- Ascertaining that correct amount of VAT has been charged to the buyers on the invoice for sale of goods/ services;

- Verification of duty paying documents for correct availment of Input Tax Credit;

- Checking of mapping of Eligible and Ineligible Input Tax Credit in Accounting Software;

- Verification of details of services/ goods received from a supplier located outside UAE / designated zone/s (if applicable);

- Computation of input VAT credit for offset / adjustment with output tax liability;

- Computation of net output tax liability (after availing input credit) of VAT for deposit with Government Treasury;

- Assistance in submission of vat return on FTA portal;

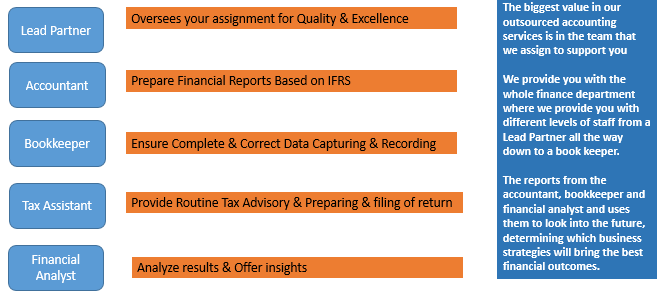

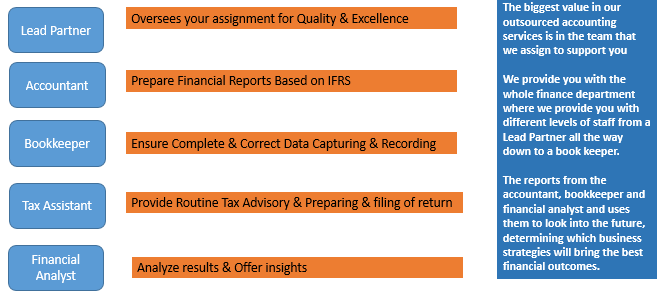

MBG Team for Accounting Outsourcing Arrangement