Taxation of Free Zone Person

January 30, 2024

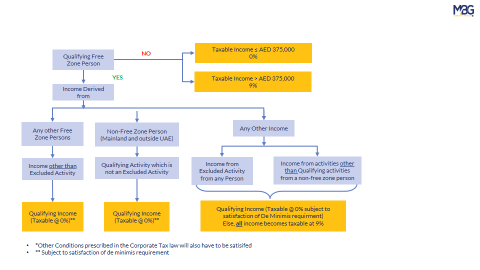

A Free Zone Person that is a Qualifying Free Zone Person can benefit from a preferential Corporate Tax rate of 0% on their “Qualifying Income” only.

The UAE Ministry of Finance has announced the issuance of Cabinet Decision No. 100 of 2023 on Determining Qualifying Income, as well as Ministerial Decision No.265 of 2023 on Qualifying Activities and Excluded Activities.

In order to be considered a Qualifying Free Zone Person, the Free Zone Person must:

- maintain adequate substance in the free zone;

- derive ‘Qualifying Income’;

- not have made an election to be subject to Corporate Tax at the standard rates; and

- comply with the transfer pricing requirements under the Corporate Tax Law.

- Ensuring non-qualifying revenues do not exceed the de-minimis requirements

- preparing audited Financial Statements in accordance with the law

Non-adherence to any of the conditions could result in the loss of the benefit not only for that year but also for the subsequent four years, even if all conditions are fulfilled thereafter.

Comparative Tax rates for Mainland vs. Free Zone| Mainland | Free Zone Entities |

| Nil for taxable profits upto AED 375000 | Nil on qualifying income |

| 9% on taxable profits exceeding AED 375.000 | 9% on Non-qualifying income |

- Fund management services that are subject to the regulatory oversight of the competent authority in the State.

- Treasury and financing services to Related Parties.

- Manufacturing of goods or materials.

- Ownership, management and operation of Ships.

- Holding of shares and other securities.

- Logistics services.

- Financing and leasing of Aircraft, including engines and rotable components.

- Reinsurance services that are subject to the regulatory oversight of the competent authority in the State.

- Processing of goods or materials.

- Headquarters services to Related Parties.

- Wealth and investment management services are subject to the regulatory oversight of the competent authority in the State.

- Any activities that are ancillary to the Manufacturing, treasury and financing services of related parties

- Distribution of goods or materials in or from a Designated Zone to a customer that resells such goods or materials, or parts thereof or processes or alters such goods or materials or parts thereof for the purposes of sale or resale.

Recent Update

Under the revised Cabinet Decision issued in November 2023, the scope of Qualifying Income is extended to include the amount of Qualifying Income derived from the ownership or exploitation of Qualifying Intellectual Property calculated based on the methodology of the OECD’s modified nexus approach, which is prescribed in Ministerial Decision No.265 of 2023.

Ministerial Decision 265 of 2023 on Qualifying Activities and Excluded Activities also lists the trading of Qualifying Commodities as a Qualifying Activity, which allows for the free zone 0% corporate tax rate to apply to income earned from the physical trading of metals, minerals, energy, and agricultural commodities that are traded on a recognized stock exchange, as well as the associated derivative trading income used to hedge against, the risk of such trading activities.

Additionally, the Ministerial Decision clarifies the intended scope of Qualifying Activities and Excluded Activities thereby providing clarity and certainty to free zone businesses.

Impacted Taxpayers and next step

All free zone entities registered in the UAE free zones are the impacted ones.

UAE Free Zone persons with first tax periods starting on or after January 1, 2024, should prioritize examining their businesses to ensure eligibility for the preferential regime (i.e., a 0% corporate tax rate) wherever applicable.

Pre-assessment and planning are of significant importance to ensure that from 'day one' all the conditions are met. It takes time to implement any restructuring exercise, undertake any process correction, organize resources, evaluate pros and cons, and so on.

Some steps may be more important and urgent than others for ensuring compliance from 'day one,' and identifying those steps and taking timely action will be key to safeguarding a 0% benefit.

The UAE Free zones should carry out analysis as to whether the activities are qualifying activities or not. A simplified approach presented in the flow chart can be used for easy referencing

MBG has a core Corporate Tax team and we can help you in evaluation and assessment as to whether you are entitled for zero percent tax or not.

Disclaimer

These materials and the information contained herein are provided by MBG and are intended to provide general information on a particular subject or subjects and are not an exhaustive treatment of such subject(s).

Accordingly, the information in these materials is not intended to constitute accounting, tax, legal, investment, consulting, or other professional advice or services.