Latest Updates

MBG

Middle East

News

Understanding Economic Substance Regulations in the UAE

January 15, 2020

The UAE introduced a Resolution no. 31 of 2019 on Economic Substance to ensure entities in UAE are real in operations and must not undertake relevant activity to book artificial profits that are not comparable to the size of economic activity undertaken.

Economic Substance rules formulated by the European Union Code of Conduct Group on Business Taxation aligned with the Base Erosion and Profit Shifting (BEPS) directives of the Organization for Economic Co-operation and Development’s (OECD).

Applicability:

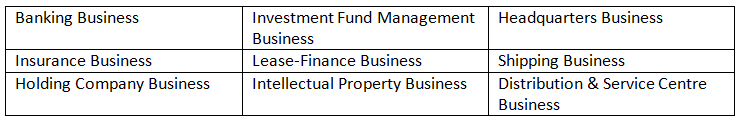

Every business (consisting of onshore, free zone or any form of business) that carry out relevant activities during the financial year starting on or after 1st January 2019, (except for the Exempt Entities, those are directly or indirectly at least 51% owned by the Federal or an Emirate government, or a UAE government body or authority).Relevant Activity (RA):

Following parameters must be achieved to substantiate economic activity within UAE:

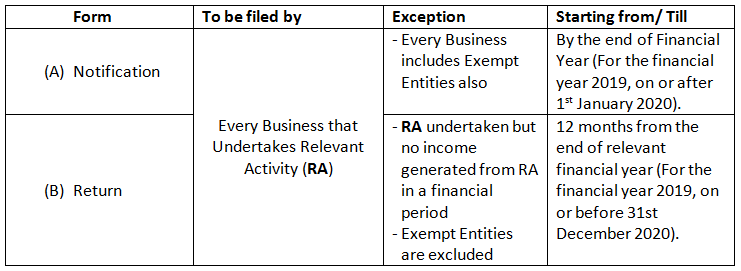

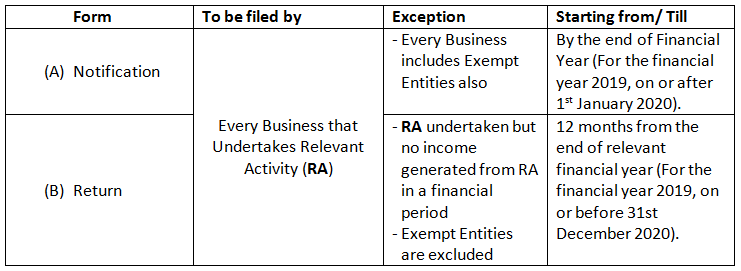

Compliance:

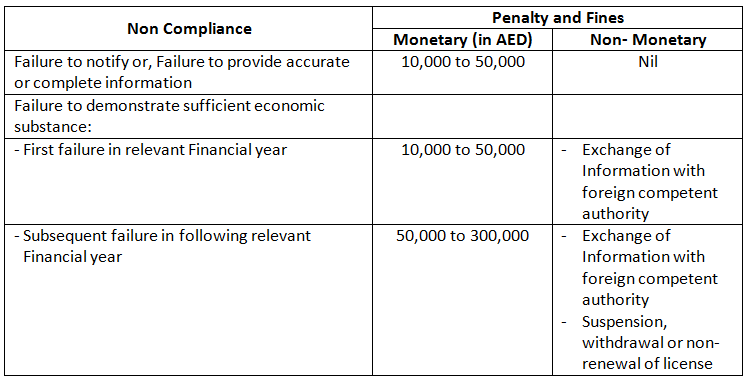

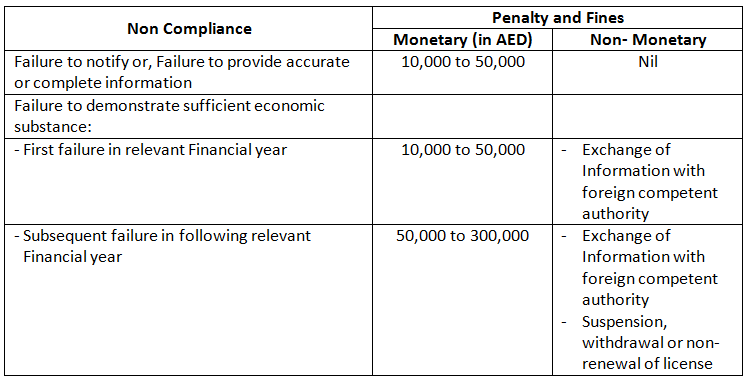

Fines for Non-compliance:

How we can help:

- Assessment of applicability of provisions

- Gap Analysis

- Advisory on bridging the Gaps

- Compliance Services

Last Updated: 15th January 2020

This article is contributed by:

Amit Mehta Associate Director