News from the desk of Ministry of Corporate Affairs (MCA)

August 19, 2021

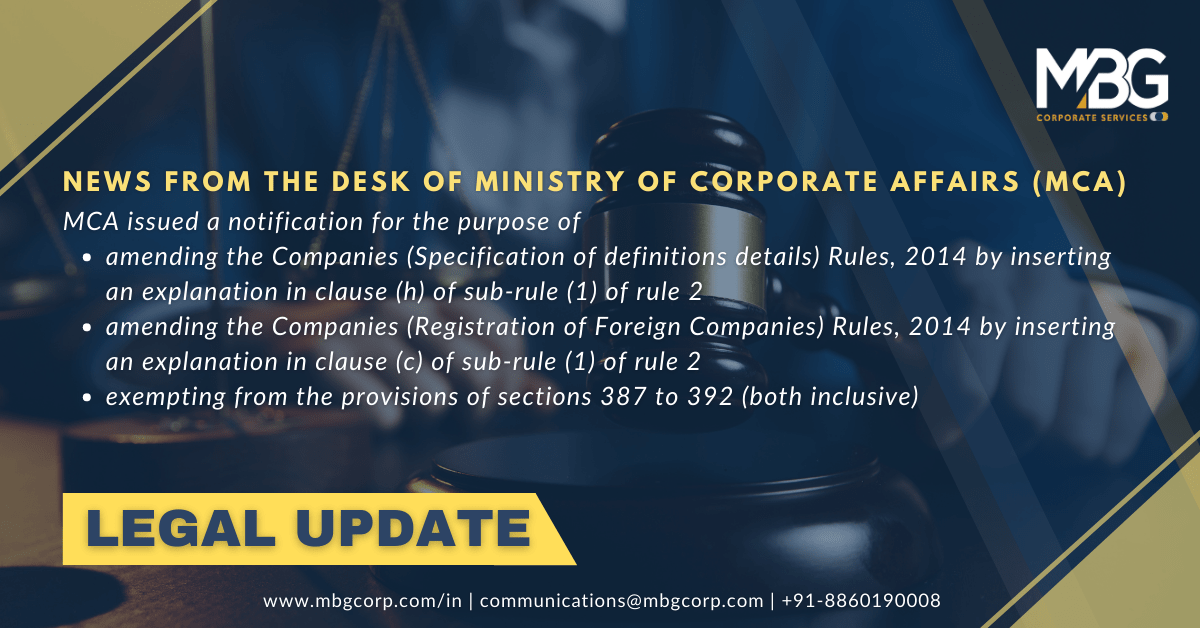

Ministry of Corporate Affairs (MCA) on 05th day of August, 2021 issued a notification for the purpose of amending the Companies (Specification of definitions details) Rules, 2014 (“Notification”) by inserting an explanation in clause (h) of sub-rule (1) of rule 2 which is produced as under:-

Rule 2 (1) (h) defines “electronic mode”, for the purposes of clause (42) of section 2 (foreign company) of the Companies Act, 2013 which means carrying out electronically based, whether main server is installed in India or not, including, but not limited to - business to business and business to consumer transactions, data interchange and other digital supply transactions etc.

Therefore, for the sake of providing clarity an explanation has been inserted which is as follows:-

“Explanation.- For the purposes of this clause, electronic based offering of securities, subscription thereof or listing of securities in the International Financial Services Centers set up under section 18 of the Special Economic Zones Act, 2005 shall not be construed as ‘electronic mode’ for the purpose of clause (42) of section 2 of the Act.”.

The said rules shall be effective from date of its publication i.e. 05th day of August, 2021.

The complete text of the Notification may be viewed at below link:

https://www.mca.gov.in/bin/dms/getdocument?mds=tNqRdFZSB569p6ed%252Bx7BZw%253D%253D&type=open

News from the desk of Ministry of Corporate Affairs (MCA)

Ministry of Corporate Affairs (MCA) on 05th day of August, 2021 issued a notification for the purpose of amending the Companies (Registration of Foreign Companies) Rules, 2014 (“Notification”) by inserting an explanation in clause (c) of sub-rule (1) of rule 2 which is produced as under:-Rule 2 (1) (c) defines “digital signature” as the digital signature as defined under clause (p) of sub-section (1) of section 2 of the Information Technology Act, 2000.

Therefore, for the sake of providing clarity an explanation has been inserted which is as follows:-

“Explanation.- For the purposes of this clause, electronic based offering of securities, subscription thereof or listing of securities in the International Financial Services Centers set up under section 18 of the Special Economic Zones Act, 2005 shall not be construed as ‘electronic mode’ for the purpose of clause (42) of section 2 of the Act.”.

The said rules shall be effective from date of its publication i.e. 05th day of August, 2021.

The complete text of the Notification may be viewed at below link:<?p>

https://www.mca.gov.in/bin/dms/getdocument?mds=OhiAmBDG37Yyf743tXeFeA%253D%253D&type=open<?p>

News from the desk of Ministry of Corporate Affairs (MCA)

Ministry of Corporate Affairs (MCA) on 05th day of August, 2021 issued a notification for the purpose of exempting, from the provisions of sections 387 to 392 (both inclusive), the following:-

(a) foreign companies;

(b) companies incorporated or to be incorporated outside India, whether the company has or has not established, or when formed may or may not establish, a place of business in India,insofar as they relate to the offering for subscription in the securities, requirements related to the prospectus, and all matters incidental thereto in the International Financial Services Centers set up under section 18 of the Special Economic Zones Act, 2005”.

The said rules shall be effective from date of its publication i.e. 05th day of August, 2021.

The complete text of the Notification may be viewed at below link:

https://www.mca.gov.in/bin/dms/getdocument?mds=Is22cx67XZW0vh1aS%252Fy72A%253D%253D&type=open

Last updated: 19/08/2021

Article contributed by:

Senior Associate- Legal

Also Read:-

- News from the desk of MCA, EPFO and MSME

- Clarification on spending of CSR funds for setting up makeshift hospitals and temporary COVID care facilities

- Companies (Share Capital and Debentures) Amendment Rules, 2021 : Ministry of Corporate Affairs (MCA):

- MCA extends due dates for conducting board meetings for restricted items and has issued a clarification on the passing of ordinary and special resolutions by companies

- MCA Extends Suspension of Fresh Proceedings Under the Insolvency and Bankruptcy Code (IBC) Till Mar’2021 and Appoints 21/12/2020 as date for Certain Provisions to Come Into Force